Nv payroll calculator

Get Started With ADP Payroll. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your.

Texas Paycheck Calculator Smartasset Com Paycheck Calculator Nevada

Free Unbiased Reviews Top Picks.

. Calculating your Nevada state income tax is similar to the steps we listed on our Federal paycheck calculator. This free easy to use payroll calculator will calculate your take home pay. Below are your Nevada salary paycheck results.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. Nevada Hourly Paycheck Calculator Results. Use ADPs Nevada Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. Paycheck Results is your gross pay and specific. Supports hourly salary income and multiple pay frequencies.

Nevada Hourly Paycheck and Payroll Calculator. Below are your Nevada salary paycheck results. Employment Security Division New Hire Unit.

Nevada Salary Paycheck Calculator. Your Nevada employer will. Ad Compare This Years Top 5 Free Payroll Software.

Here When it Matters Most. Below are your Nevada salary paycheck results. For 2022 Nevadas unemployment insurance rates range from 025 to 540 with a taxable wage base of up to 36600 per employee per year.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. All Services Backed by Tax Guarantee.

Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is. How Your Nevada Paycheck Works. Withhold 62 of each employees taxable wages until they earn gross pay.

Use this Nevada gross pay calculator to gross up wages based on net pay. Just enter the wages tax withholdings and other information required. Ad Payroll So Easy You Can Set It Up Run It Yourself.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. Nevada Hourly Paycheck Calculator.

For example if an employee receives 500 in take-home pay this calculator can be. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Nevada. Customized Payroll Solutions to Suit Your Needs.

Carson City NV 89713-0033. Excise taxes on alcohol in Nevada depend on the alcoholic content of the beverage being sold. Need help calculating paychecks.

500 East Third Street. This free easy to use payroll calculator will calculate your take home pay. Ad Process Payroll Faster Easier With ADP Payroll.

Nevada may not charge any state income taxes but residents still have to pay federal income taxes and FICA taxes. Department of Employment Training and Rehabilitation. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Supports hourly salary income and multiple pay frequencies. The results are broken up into three sections.

Ad Process Payroll Faster Easier With ADP Payroll. Free Unbiased Reviews Top Picks. If youre starting a new small.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. The Nevada Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nevada State. Calculating paychecks and need some help.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. The results are broken up into three sections. Wine is taxed at a rate of 70 cents per gallon beer at a rate.

Ad Compare This Years Top 5 Free Payroll Software. It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Nevada Alcohol Tax.

All Services Backed by Tax Guarantee. The results are broken up into three sections. Calculate your Nevada net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

As Much As We Like Numbers We Know Buying Is Not Only About Numbers There Are Several Intangible Factors That Go Into The Buy Or Rent Rent Renter This Is Us

Nevada Paycheck Calculator Smartasset

Calculators At Lowes Com

Child Support Calculator In Nevada Formula Maximum

Payroll Tax Calculator For Employers Gusto

Should You Move To A State With No Income Tax Forbes Advisor

Pin By Lovely Lady On Credit Hacks Things To Know In 2022 News Apps Nevada State Trans Union

How Will A Court Calculate Child Support Child Support Quotes Child Support Laws Child Support Payments

New York Hourly Paycheck Calculator Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Bookkeepers Have Two Types Of Billing They Use For Their Services Hourly And Flat Rate Here Invertir En Bolsa Gestion De Recursos Humanos Gestion De Recursos

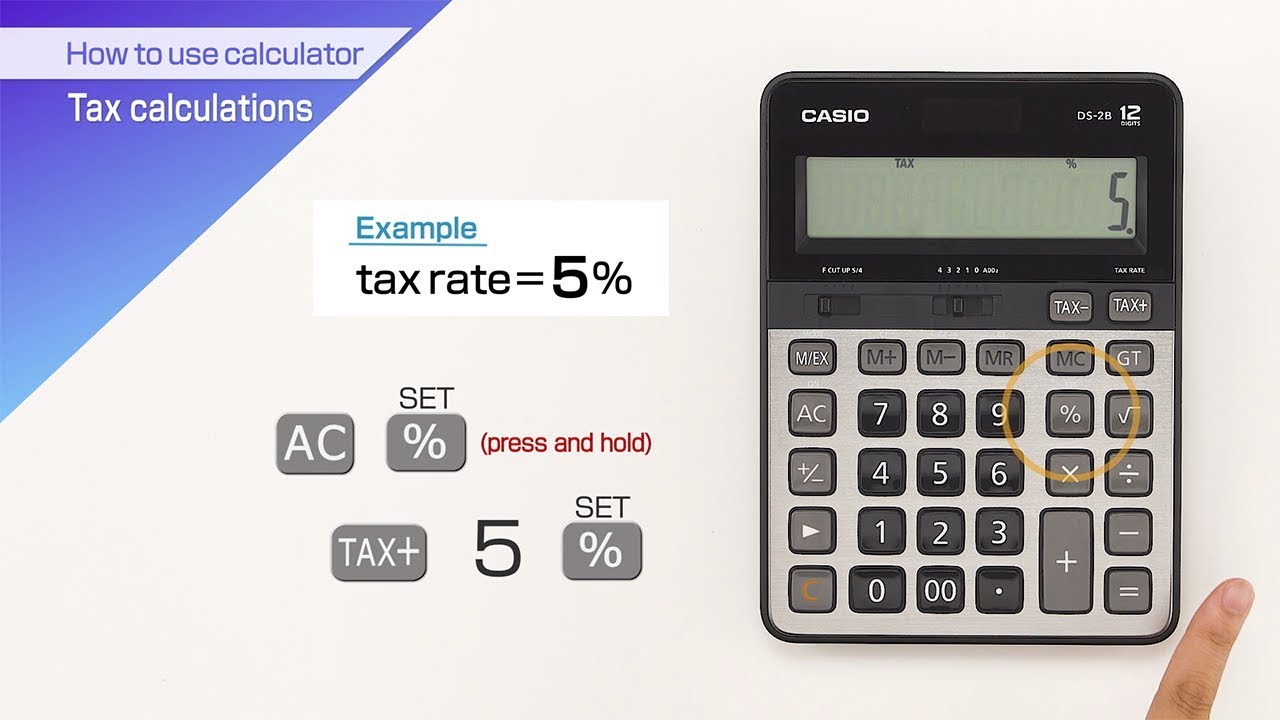

Casio How To Use Calculator Tax Calculations Youtube

Calculators At Lowes Com

How To Calculate Payroll Taxes Methods Examples More

Employer Payroll Tax Calculator Incfile Com